Job Growth & Unemployment, June 30, 2025

Chris Ramser, Vice President, Research

Insights

-

- Austin is the 10th best performing among the top 50 metros, adding 18,500 jobs, or 1.4% growth, in the year ending in May.

- The fastest job growth over the last 12 months occurred in Austin’s education and health services and financial activities, both growing at 3.6%.

- Three industries, most notably information (-5.2%), have fewer jobs now than one year ago.

- Austin’s seasonally adjusted unemployment rate is 3.5% in May, unchanged from April.

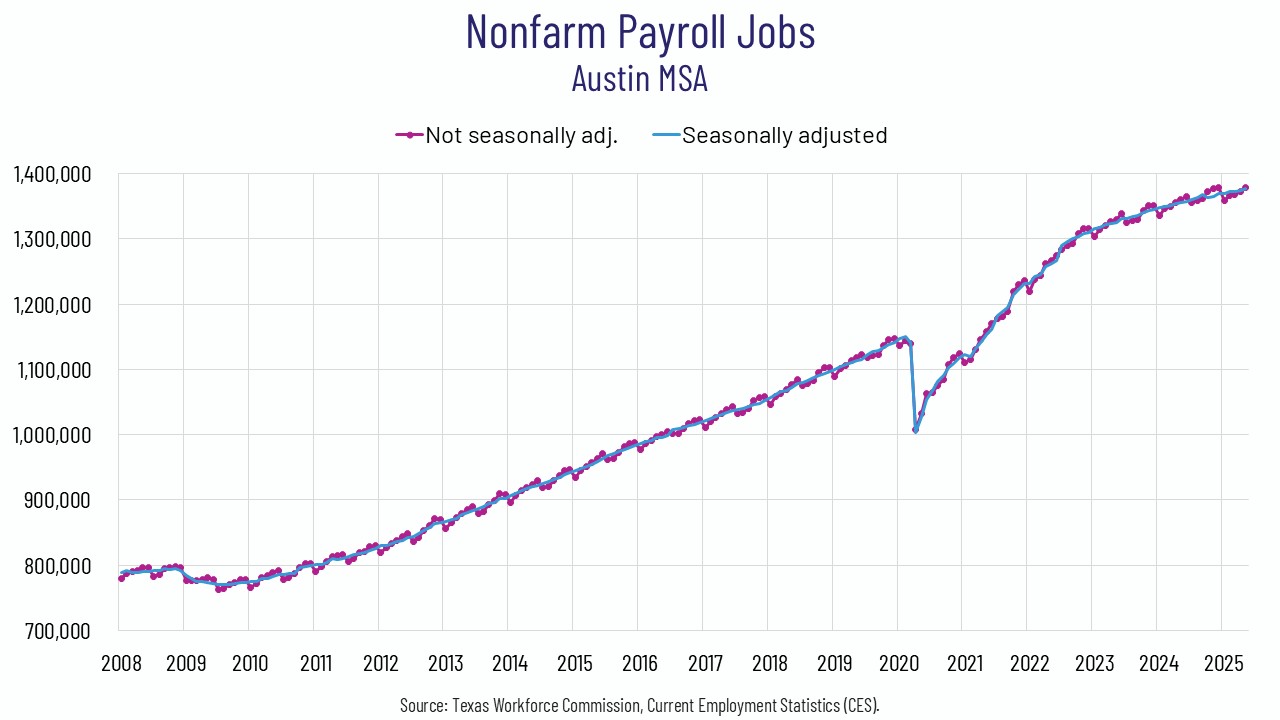

Nonfarm payroll jobs

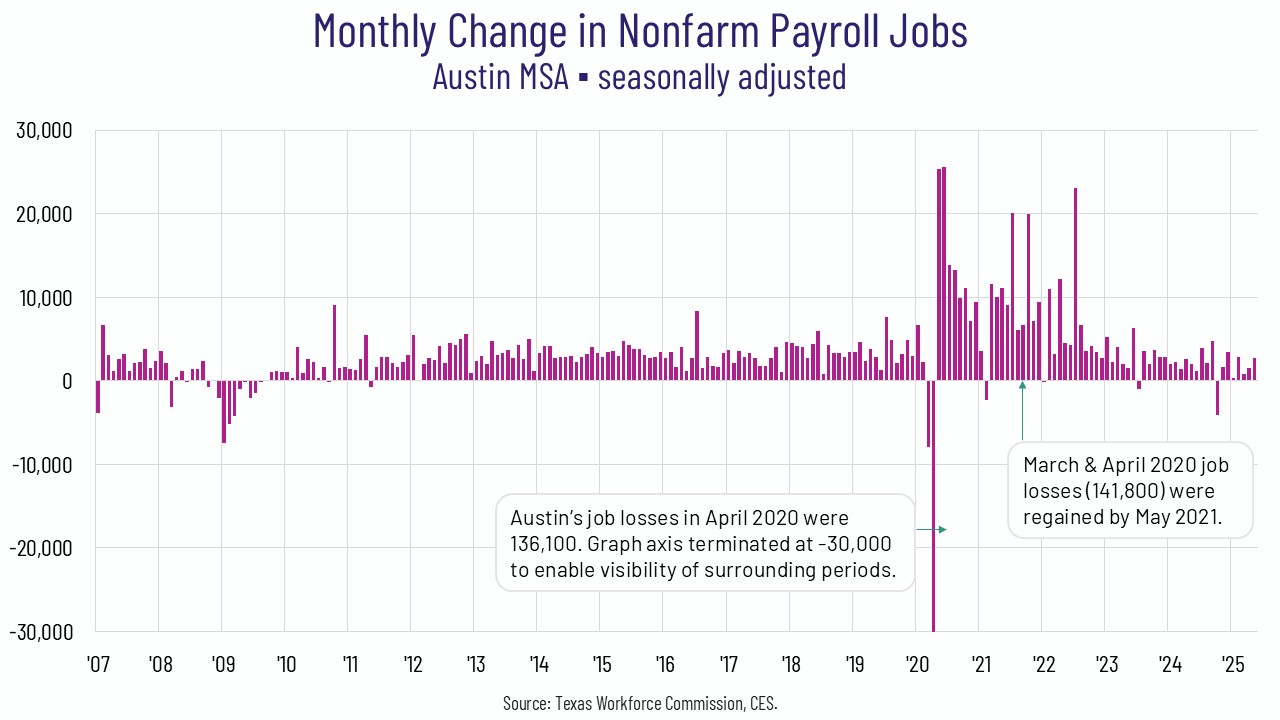

Jobs in the Austin MSA increased by 18,500 (1.4%) from May 2024 to May 2025, according to the latest monthly labor market data from the Texas Workforce Commission and the U.S. Bureau of Labor Statistics. On a seasonally adjusted basis, Austin jobs increased by 2,700 or 0.2% from April to May.

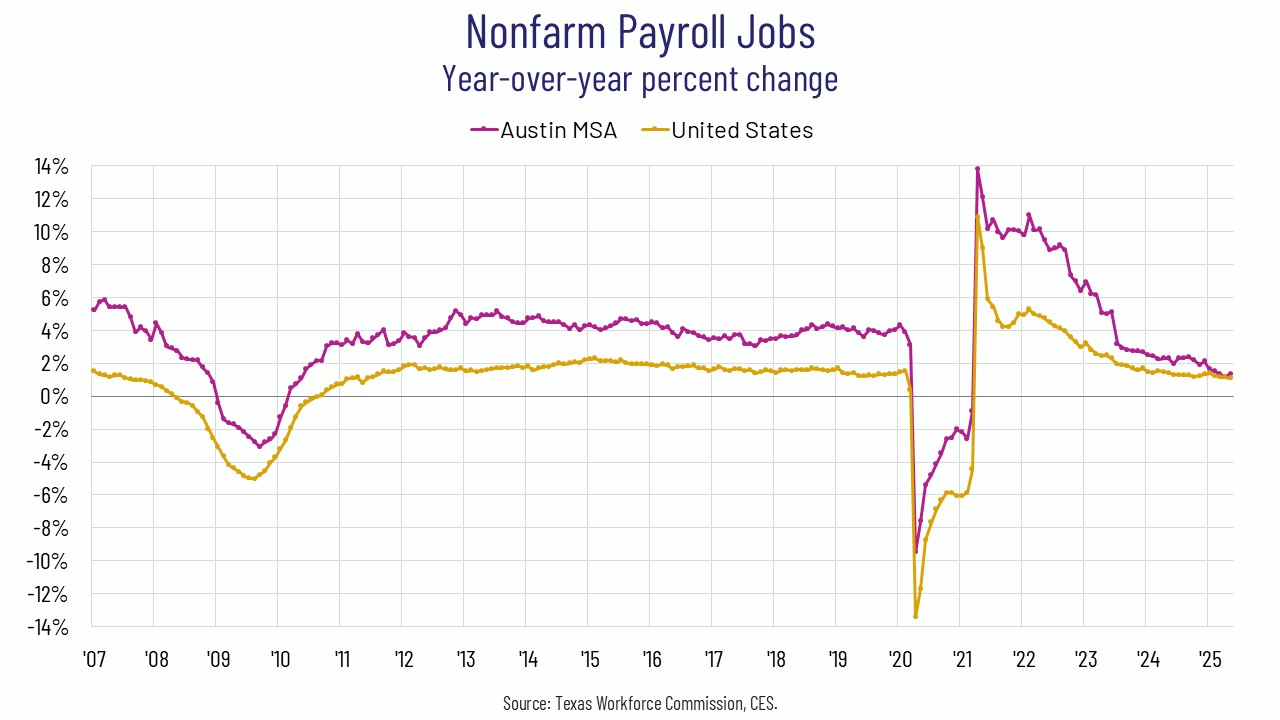

Austin’s year-over-year (YOY) increase of 1.4% makes it the 10th best performing among the 50 largest metros. Two other Texas metros, San Antonio (2.1%) and Fort Worth (1.5%), also rank in the top 10 this month. Job growth for the Top 50 largest metros is 0.7% in aggregate, while the top 10 fastest-growing metros averaged 1.8%. Dallas (0.9%) and Houston (0.9%) rank 20th and 23rd. Seven of the 50 largest metros saw negative job growth over the last 12 months, with Oakland (-1.0%) and San Francisco (-0.8%) seeing the lowest growth rates.

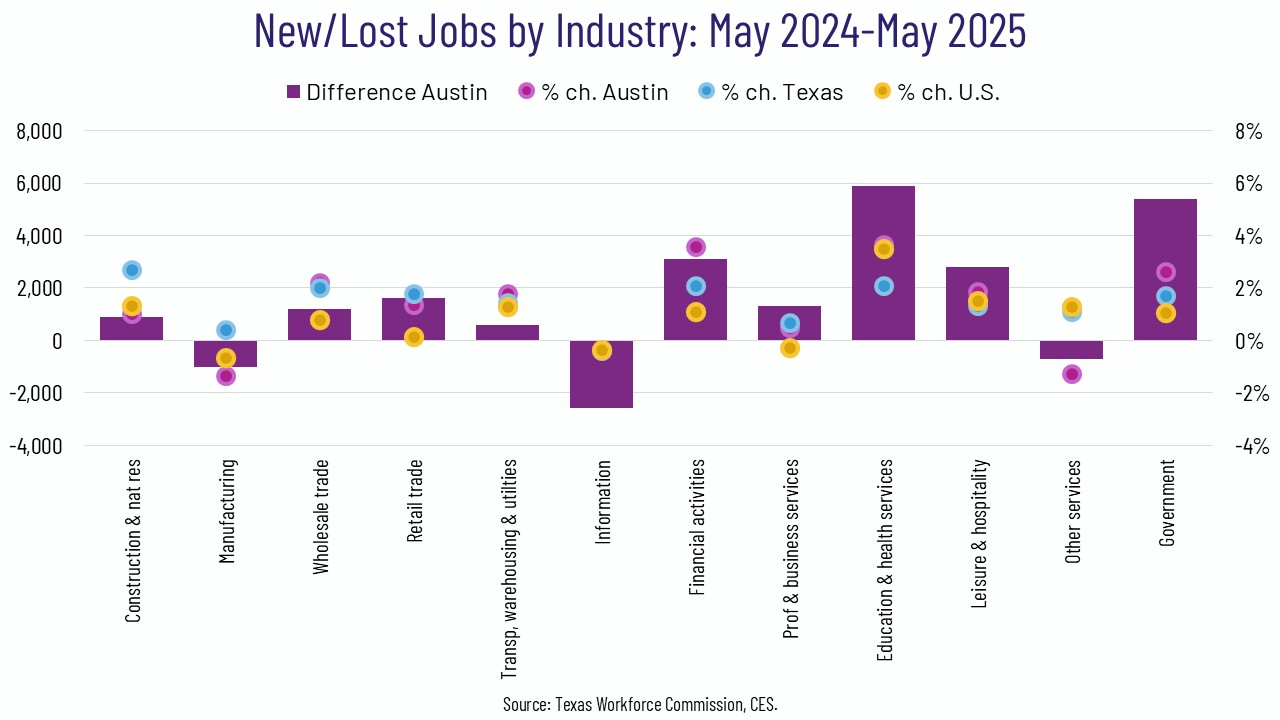

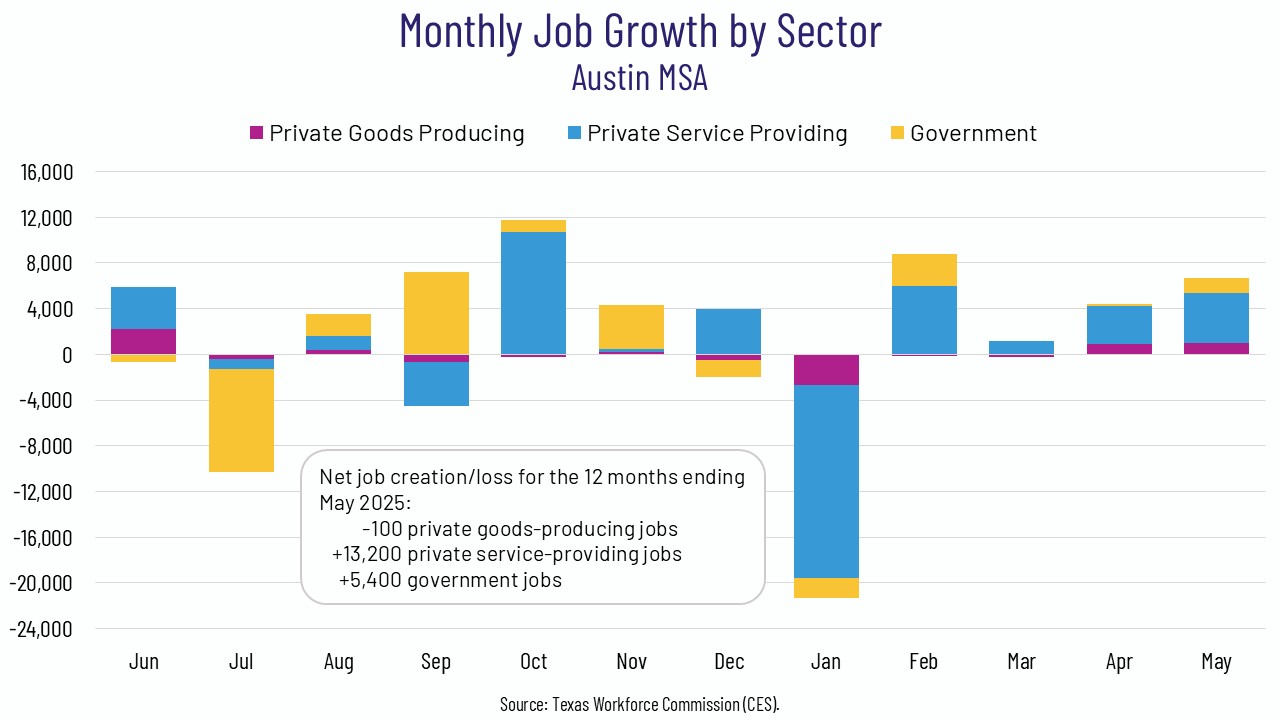

For the year ending in May, private sector job growth in the Austin MSA is 1.1%, or 13,100 jobs, with gains across 8 of the 11 major private industry sectors. Total job growth was higher, at 1.4%, as the government sector, which accounts for 15% of metro area employment, grew by a robust 2.6%.

Texas saw net private sector job growth of 1.5%, with all private industry groups adding jobs over the last 12 months. Total job growth was also 1.5%, due in part to comparable (1.7%) growth in the government sector. For the nation, private sector job growth was 1.1% for the 12 months ending in May, with all but three private industries adding jobs. Overall job growth was also 1.1%, due to comparable government sector growth (1.0%).

Jobs in May are up by 6,700 or 0.5% from April in the not-seasonally-adjusted series for Austin. The seasonally adjusted series also shows positive job growth, with a gain of 2,700 jobs or 0.2%. Seasonally adjusted job growth varied across the other major Texas metros. Fort Worth and San Antonio performed best, up 0.3% and 0.2%, respectively, while Dallas was essentially unchanged at 0.02%, and Houston was down -0.2%. Nationally, seasonally adjusted jobs are up 0.1%.

In Austin, eight of the 11 major private industry sectors added jobs over the last 12 months. Education and health services is the fastest growing (3.6%) and added the most jobs, at 5,900, while financial activities also grew by 3.6% and added 3,100 jobs. Wholesale trade and leisure and hospitality were also relatively fast growing (2.2% and 1.8%, respectively). The three industries with negative YOY growth were information (down 5.2% or 2,600 jobs), manufacturing (-1.4% or 1,000), and other services (-1.3% or 700).

After 14 consecutive months of year-over-year decline, professional and business services began seeing growth in October 2024. Because the industry accounts for more than 20% of Austin’s jobs and has historically been among the metro’s fastest-growing, the industry’s negative and now modest growth has a notable impact on overall job growth. With 279,100 jobs in May 2025, the industry added 1,300, or 0.5% growth over the last year.

Statewide, the private industry with the most significant YOY growth is construction and natural resources (2.7%), while financial activities and education and health services were also fast growing, each growing by 2.1%. Information was the only industry (-0.4%) losing jobs over the last 12 months.

Nationally, education and health services (3.5%) and leisure and hospitality (1.5%) were the leading private sector growth industries over the last 12 months. Manufacturing lost jobs (-0.7%), as did information (-0.4%) and professional and business services (-0.3%).

Over the last 12 months, the net gain for private service-providing industries in Austin is 13,200 jobs, or 1.3%. Employment in goods-producing industries is down 100 jobs, or (-0.1%). Statewide, private service-providing industries are up 144,700 or 1.5%, and goods-producing industries are up 32,700 or 1.6%.

Additional graphs: The trend since 2000 for six large industries and six small industries.

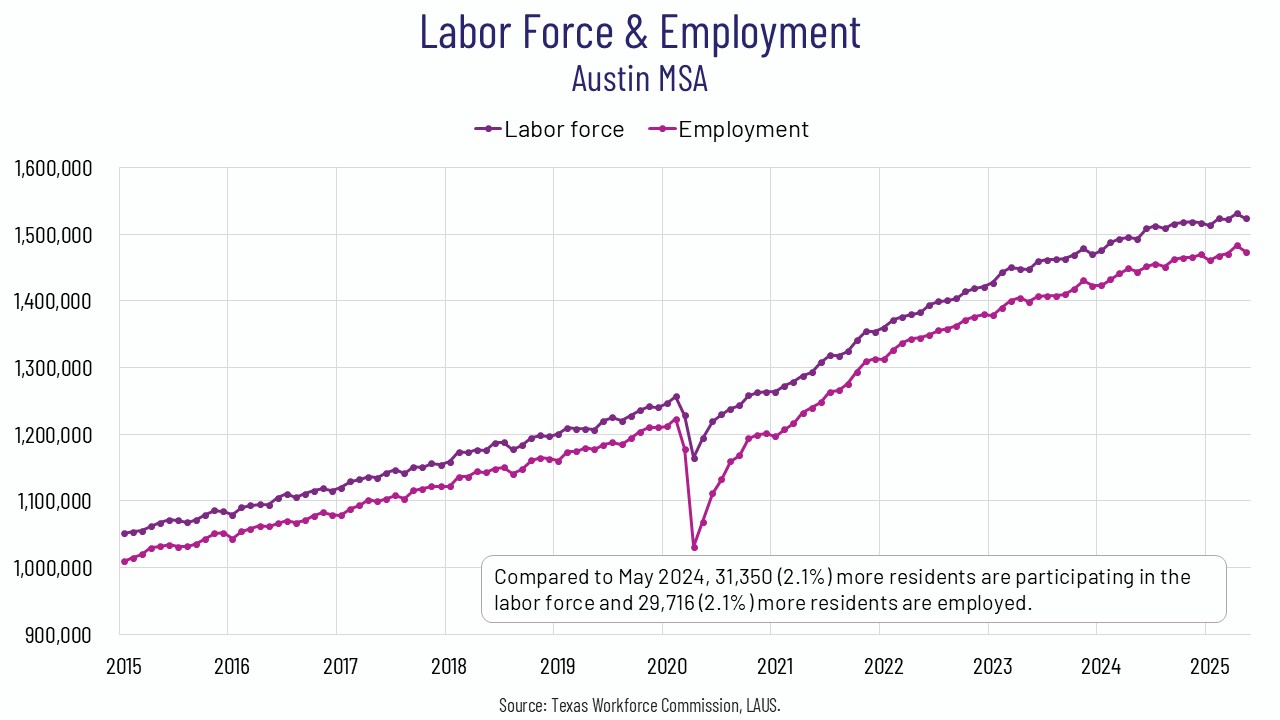

Labor force, employment & unemployment

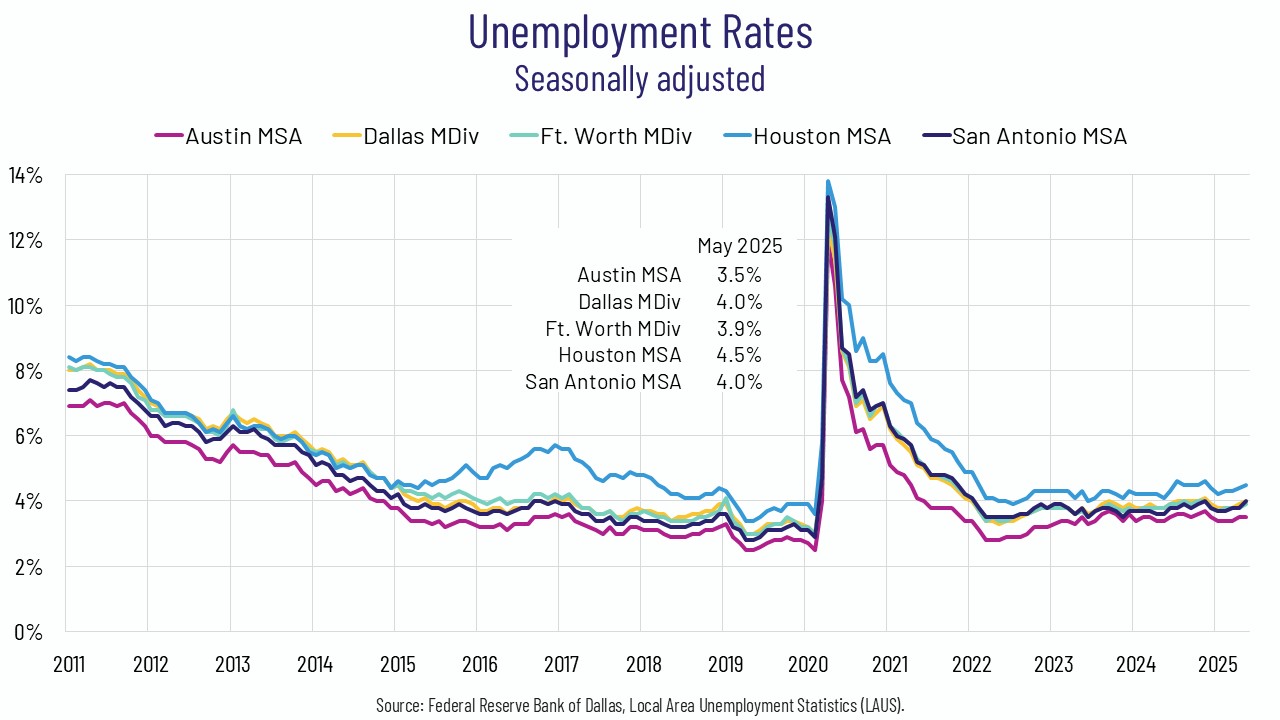

We also now have May labor force, employment, and unemployment numbers for Texas and local areas in Texas. The same data for all U.S. metros will not be released by the U.S. Bureau of Labor Statistics until July 2. In April, Austin had the 12th lowest rate of unemployment among the 50 largest metros. Data for May show Austin sustains its superior performance relative to the state and the other major Texas metros.

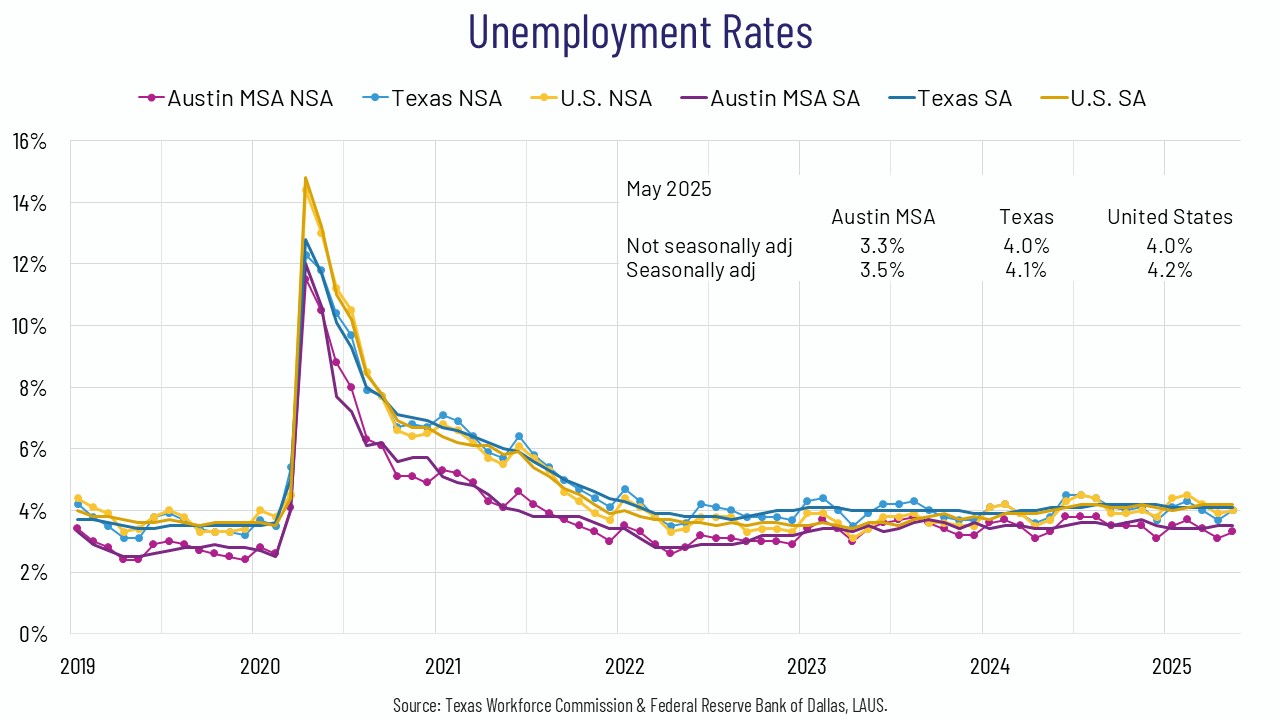

In May, Austin’s not-seasonally-adjusted unemployment rate is 3.3%, unchanged from a year ago. Rates in the other major Texas metros range from 3.7% in Dallas, Fort Worth, and San Antonio to 4.2% in Houston. The Dallas, Fort Worth, Houston, and San Antonio rates are 0.0 to 0.3 percentage points higher than last year. The statewide rate is now 4.0%, up from 3.8% in May of last year. The national unemployment rate is 4.0%, up from 3.7% a year ago.

May unemployment rates are 3.3% in Travis County, 3.4% in Hays and Williamson Counties, 3.5% in Caldwell County, and 3.6% in Bastrop County.

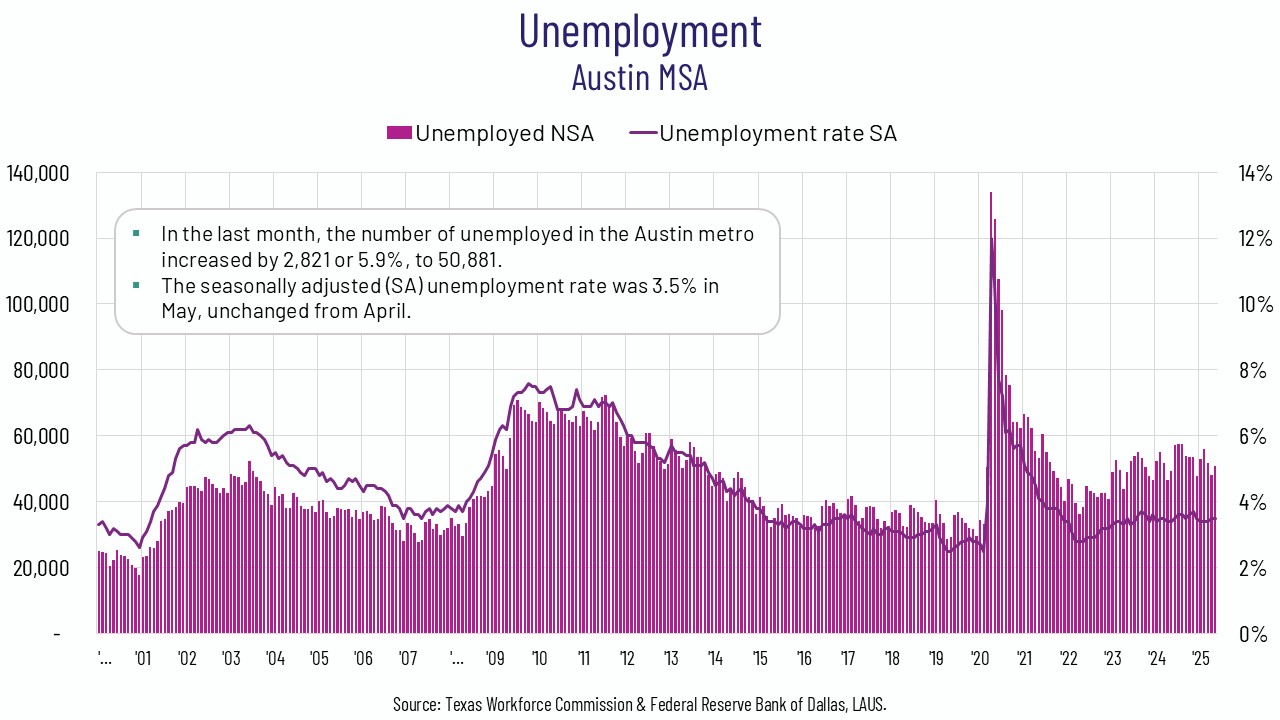

On a seasonally adjusted basis, Austin’s May unemployment rate is 3.5%, unchanged from April. Texas is at 4.1%, unchanged from April. The national rate in May is 4.2%, also unchanged from April.

Among Texas’ other major metros, Fort Worth is at 3.9%, and Dallas and San Antonio are at 4.0%. Houston is at 4.5%. Seasonally adjusted unemployment rates for Texas metros are produced by the Federal Reserve Bank of Dallas. (The Texas Workforce Commission also produces seasonally adjusted rates for Texas metros, but publication lags the Dallas Fed’s estimates.)

Among Texas’ other major metros, Fort Worth is at 3.9%, and Dallas and San Antonio are at 4.0%. Houston is at 4.5%. Seasonally adjusted unemployment rates for Texas metros are produced by the Federal Reserve Bank of Dallas. (The Texas Workforce Commission also produces seasonally adjusted rates for Texas metros, but publication lags the Dallas Fed’s estimates.)

With Austin’s unemployment rate similar to what it was one year ago, the number unemployed increased slightly. In May 2024, Austin’s number of unemployed was 49,247. Over the last 12 months, the number unemployed increased by 1,634 or 3.3%, to 50,811. This is due to a smaller increase in the number employed compared to the labor force. The Austin metro’s civilian labor force (employed plus unemployed) increased by 31,350 persons or 2.1% from one year ago, while persons employed increased by 29,716 or 2.1%.

Additional graphs – Labor force & employment: Texas and United States.

Additional graphs – Labor force & employment: Texas and United States.

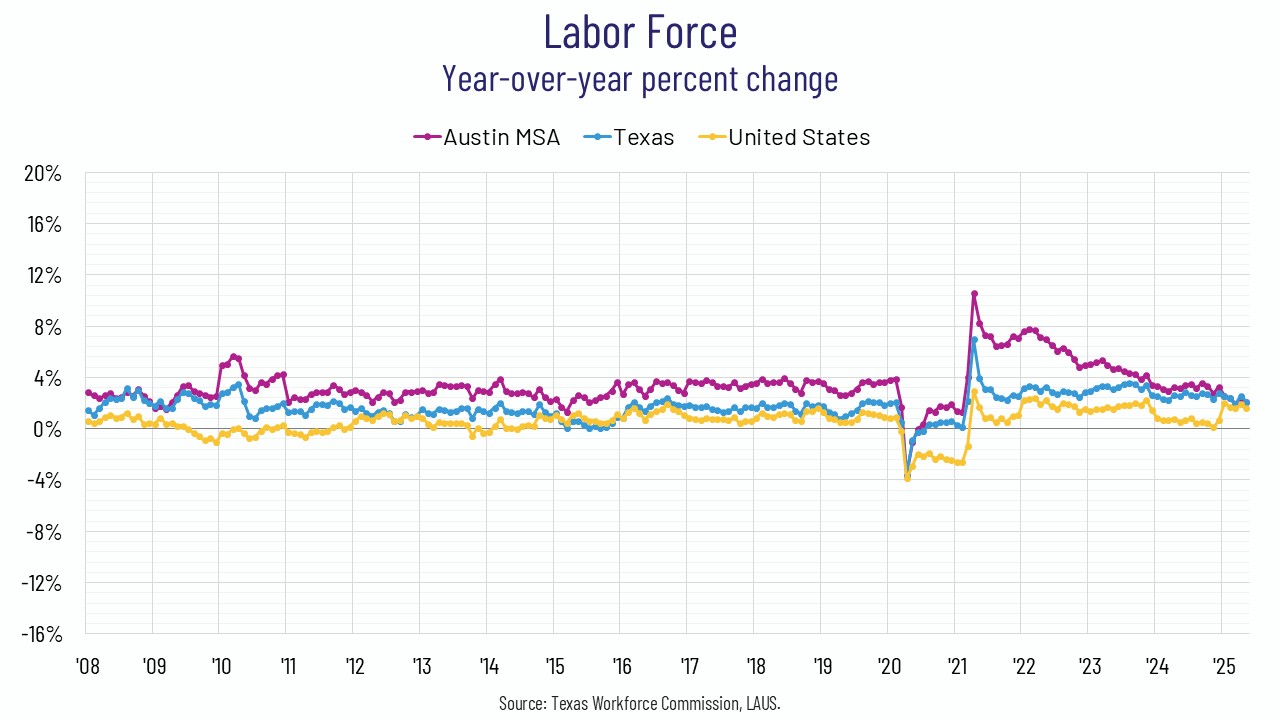

Texas’ labor force growth (324,694 or 2.1%) over the last 12 months exceeds the growth in the number employed (280,720 or 1.9%). Thus, the number of unemployed increased by 43,974 or 7.5%. Nationally, May’s labor force is up by 2,640,000 or 1.6%, while the number employed is above the level of a year ago by 2,060,000 or 1.3%, and 580,000 more people (9.3%) are unemployed.

Conclusion

Recent months have seen Austin’s and Texas’ job growth slow. Austin’s YOY job growth averaged 2.2% in 2024, and Texas was at 1.5%. Thus far for 2025, Austin’s YOY growth is averaging 1.4%, while Texas is at 1.5%. Typically, Austin’s job growth leads the nation. In fact, during the Great Recession and the pandemic, Austin’s annual average growth ranged from 3.4% to 4.7% and averaged 4.0%.

The Dallas Fed’s June forecast indicates jobs will increase by 2.0% for Texas in 2025, which indicates growth may pick up slightly for the second half of the year.

Despite the recent performance relative to the state on payroll job creation, Austin continues to rank in the Top 10 for YOY job growth among the largest metros, and the unemployment rate remains lower than the state and the other major Texas metros.

The Texas Workforce Commission and the U.S. Bureau of Labor Statistics will release June estimates on July 18.